Tech News and Miscellany

- Thread starter PatrThom

- Start date

More options

Export threadSomeone seriously fell down on their security job over in Argentina.

therecord.media

therecord.media

--Patrick

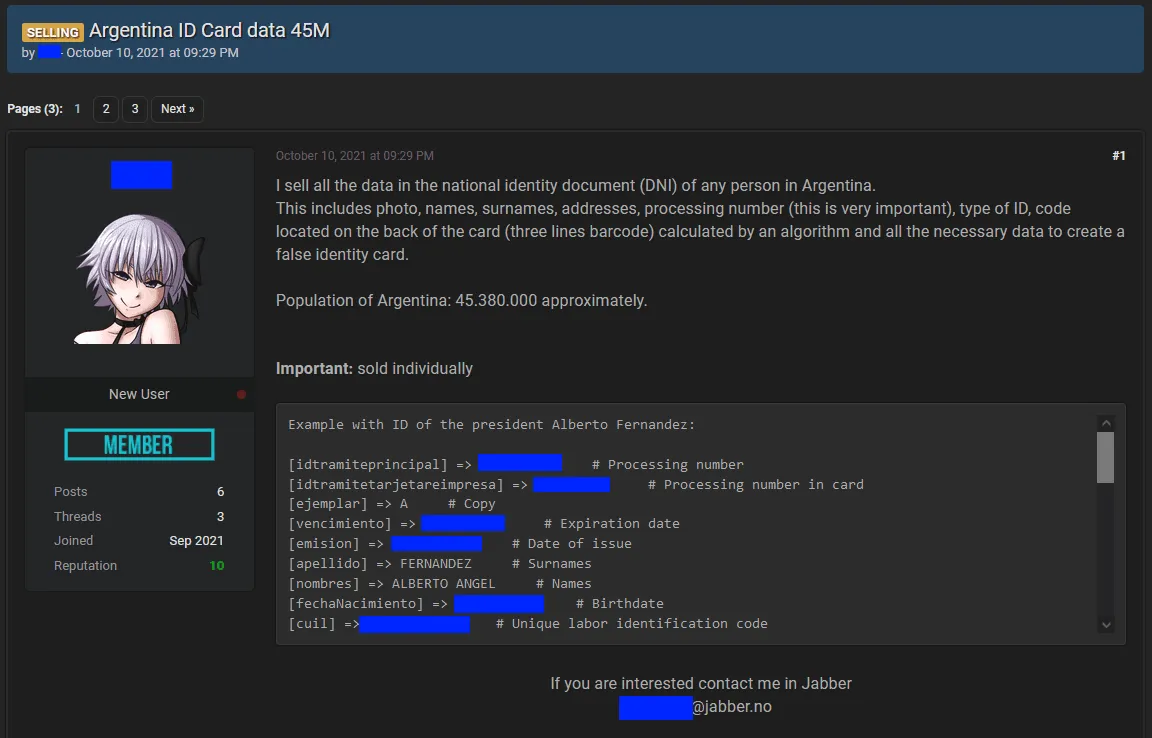

Hacker steals government ID database for Argentina's entire population

A hacker has breached the Argentinian government\'s IT network and stolen ID card details for the country\'s entire population, data that is now being sold in private circles.

--Patrick

Last edited:

Want!This new 3070 card is a real hoot...

Welcome, Wētā Digital!

Today, Unity announced that it has entered into a definitive agreement to acquire Weta Digital, specifically its artist tools, core pipeline, intellectual property, and award-winning engineering talent

I guess they got scared by The Mandalorian.

--Patrick

SO big day for yerfukt news:

www.bleepingcomputer.com

www.bleepingcomputer.com

arstechnica.com

arstechnica.com

--Patrick

High severity BIOS flaws affect numerous Intel processors

Intel has released an advisory to confirm the existence of two high-severity vulnerabilities that affect a wide range of Intel processor families.

DDR4 memory protections are broken wide open by new Rowhammer technique

Researchers build “fuzzer” that supercharges potentially serious bitflipping exploits.

arstechnica.com

arstechnica.com

--Patrick

Haven't watched the video, but honestly, I've given up for now as far as GFX cards are concerned. New releases are either re-releases of older cards with a bit of tocuh-up, but at high MSRP and even so they sell for even more - and why would I want to pay over full MSRP for a card with thechnology from 2019? - or they're completely out of the realm of normal purchasing - double or triple the MSRP- or they're hobled versions deliberately made to not be useful.

Liar.Nah. Not gonna do it again.

...but yeah, a lot of the "new" cards either feel like, "We're out of ideas and don't know where to go from here" or else "We made changes that would probably benefit miners IF we ever intended to sell them to miners, which we of course don't WINK WINK."

--Patrick

GasBandit

Staff member

Man, sure wish this blockchain fad would fuckin die off already.

Not that I need a new video card though I guess. My 1060 may be from 2016, but then again the majority of games I play are at least that old as well. These days everybody's all Tarkov this and Squad that and I have SO little interest in them.

Not that I need a new video card though I guess. My 1060 may be from 2016, but then again the majority of games I play are at least that old as well. These days everybody's all Tarkov this and Squad that and I have SO little interest in them.

It used to be that there would be a game, and people would buy a new card to play the game, and then new games would come out that used the new card for cool stuff (hardware T&L, FSAA, RTX, whatever), and people would buy a new (better) card to play THAT game, and then newer games would get made, and so on. But yeah now it's like there's just a big pit swallowing up any new cards the instant they come out, and so the gamers are all just sitting there, frozen in 2018 because every GPU since then might as well have been vaporware.

--Patrick

--Patrick

GasBandit

Staff member

And every game since then was just the same console-friendly FPS shovelware.It used to be that there would be a game, and people would buy a new card to play the game, and then new games would come out that used the new card for cool stuff (hardware T&L, FSAA, RTX, whatever), and people would buy a new (better) card to play THAT game, and then newer games would get made, and so on. But yeah now it's like there's just a big pit swallowing up any new cards the instant they come out, and so the gamers are all just sitting there, frozen in 2018 because every GPU since then might as well have been vaporware.

--Patrick

One is strangling a hobby, the other is a very active part in our literal destruction of the earth. I'd kill blockchain, or at the very least its use for currencies, in a heartbeat.I think if I had to pick and could only end one, I would still choose to kill off KOTH/BR-type games over killing off blockchains.

--Patrick

GasBandit

Staff member

My 1060 may be from 2016, but then again the majority of games I play are at least that old as well.

figmentPez

Staff member

Newegg has been going downhill for a while. Sad to see that it's gotten this bad.

That was a bit anti-climactic. A story without an ending.Newegg messed with the wrong guy when they decided to try and screw over Tech Jesus. Thread.

figmentPez

Staff member

Due to chip shortages, Canon is producing printer ink cartridges without the DRM chip, and having to tell it's customers how to bypass the resulting error message:

The intel fanbois got triggered when I countered Hardware Unboxed's declaring the 12400 a "value" with "not so much when the price of admission to Alder Lake is also a new motherboard." Especially for upgraders. Two q1 '19 mid-range systems. One red, one blue. Want to upgrade TODAY? Red just needs to update the BIOS and drop the new CPU in. Blue has a new socket. Gotta drop an extra hundred or two on top of the new CPU.

Oh hey, looks like PCIe v6.0 has finally been finalized.

Poor PCIe v5.0, we hardly knew ye.

--Patrick

Poor PCIe v5.0, we hardly knew ye.

--Patrick

Man, I know it was never entirely exact, but the time back when at least per manufacturer you could sort-of assume bigger numbers were better and newer was better, at least kept things somewhat understandable.

The fact that some of the most expensive GFX cards are two years old, and that some of the best bang-for-buck are ven older than that, and that perhaps even the actual best cards are old while newer stuff is deliberately hobbled beyond repair.... I honestly can't properly tell which variation are or aren't worth it.

I mean, if or when I get around to it I'll make a full new build from scratch because this one's long past upgradeable, but....Ugh.

The fact that some of the most expensive GFX cards are two years old, and that some of the best bang-for-buck are ven older than that, and that perhaps even the actual best cards are old while newer stuff is deliberately hobbled beyond repair.... I honestly can't properly tell which variation are or aren't worth it.

I mean, if or when I get around to it I'll make a full new build from scratch because this one's long past upgradeable, but....Ugh.

The 6500XT is pure garbage.

source

Who knew that making a card bad for mining would also make it bad at games?

--Patrick

So most of the Internet's bandwidth was used up talking about the following two events:

-Sony pulls a Microsoft and buys Bungie for 3+ billion dollars.

-The New York Times purchases lockdown darling Wordle for somewhere between 1 and 4 million dollars.

...but there were two other purchases that I think need to be talked about, too:

-Citrix to be acquired by TIBCO, which is itself owned by private equity firm(s?) Vista Equity Partners (and Evergreen Coast Capital?), taking Citrix private. Ok whatever a tech company ate another tech company it happens all the time. But what concerns me is that it was a deal where they paid a 30% premium in cash over the going stock price. THIS is what concerns me. Why do they want to buy Citrix SO MUCH that they paid the kind of premium you usually associate with the current home-buying climate for that privilege?

-Blackberry sells its patents for $600 million to "Catapult Innovations, Inc." Just the patents. To a company that didn't really even exist until they showed up to buy the patents. And as someone else so aptly put it:

--Patrick

-Sony pulls a Microsoft and buys Bungie for 3+ billion dollars.

-The New York Times purchases lockdown darling Wordle for somewhere between 1 and 4 million dollars.

...but there were two other purchases that I think need to be talked about, too:

-Citrix to be acquired by TIBCO, which is itself owned by private equity firm(s?) Vista Equity Partners (and Evergreen Coast Capital?), taking Citrix private. Ok whatever a tech company ate another tech company it happens all the time. But what concerns me is that it was a deal where they paid a 30% premium in cash over the going stock price. THIS is what concerns me. Why do they want to buy Citrix SO MUCH that they paid the kind of premium you usually associate with the current home-buying climate for that privilege?

-Blackberry sells its patents for $600 million to "Catapult Innovations, Inc." Just the patents. To a company that didn't really even exist until they showed up to buy the patents. And as someone else so aptly put it:

I can't wait until patent trolling is declared illegal, by which I mean if the patent isn't protecting something your company actually does, then you simply shouldn't be allowed to have it.If the name "Catapult IP Innovations" didn't give it away, weaponizing BlackBerry's patents is the most obvious outcome of this deal. According to the press release, Catapult's funding for the $600 million deal is just a $450 million loan, which will immediately be given to BlackBerry in cash. The remaining $150 million is a promissory note with the first payment due in three years. That means Catapult is now a new company with a huge amount of debt, no products, and no cash flow. Assuming the plan isn't to instantly go bankrupt, Catapult needs to start monetizing BlackBerry's patents somehow, which presumably means suing everyone it believes is in violation of its newly acquired assets.

--Patrick